11

DecemberTitle Loan A Reliable Source if You Need Money Quick

Most men and women cannot find the money for a $four hundred crisis cost. These costs strike like a shock, leaving minor time to prepare.

Receiving additional cash for the duration of emergencies is crucial. You may possibly need added income to make lease payments or protect the groceries.

Not every person can wander up to a bank and question for a mortgage. Conventional loan providers set credit rating needs. If your credit rating does not tumble in their selection, you cannot get a loan.

You can increase your credit rating more than time. Nonetheless, rising your score will not likely help when you need the cash now. A title mortgage can act as your lifeline.

What Is a Title Financial loan? Vehicle title loans give you quick obtain to income. Debtors use their vehicle as collateral for the loan.

Considering that you use collateral, lenders will not request for your credit rating score.

Even folks with bad credit score can commonly increase funds with auto title loans on-line.

Creditors will give income to lower-income debtors. Some lenders will provide automobile title loans to men and women who don't make income. They incur considerably less danger because your car is the collateral.

You can just take out a title bank loan for what are the requirements to get a loan with my car any vehicle, not just a car. Some borrowers use boats, RVs, and bikes as collateral.

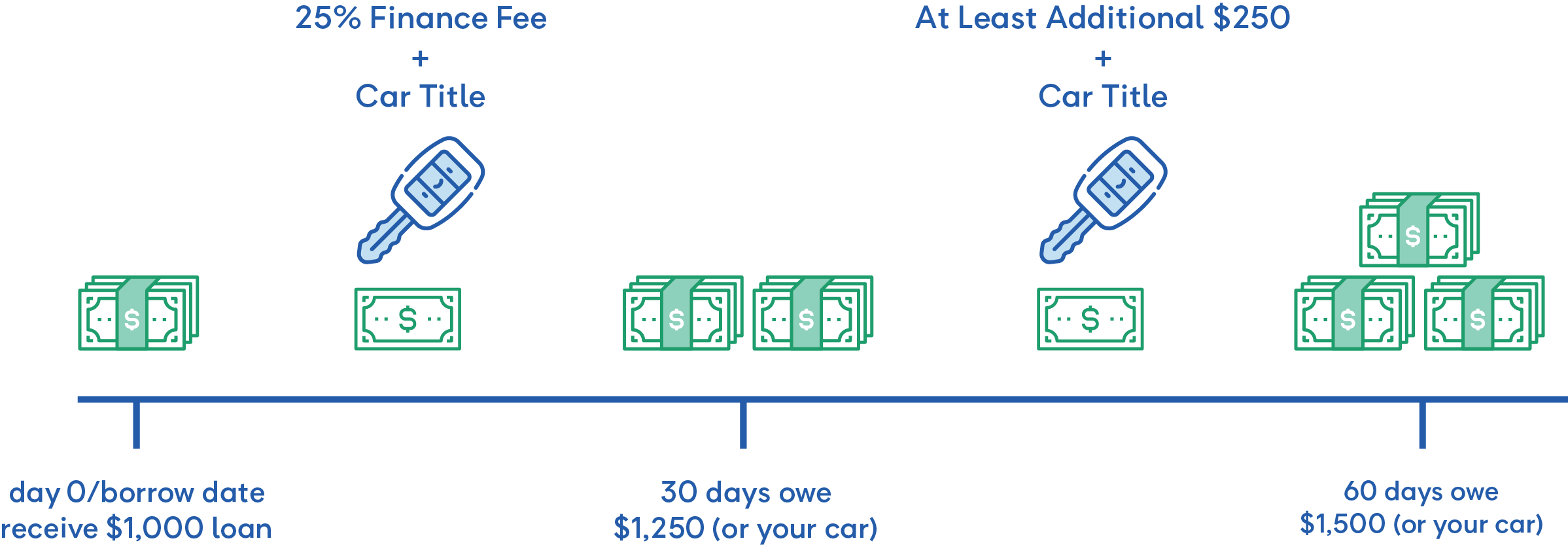

If you can't pay again the loan, the financial institution can get your vehicle.

They will sell the auto to recover losses. If their promoting price tag exceeds the mortgage amount, they give you the profits.

You can negotiate payment terms and increase your loan's deadline. Dealers will perform with you toward effectively paying off the mortgage.

what are the requirements for borrowing money using my car You Need to Get Accredited You never need a very good credit rating rating. However, you need to have some documentation to receive a title bank loan.

Before approaching lenders, assemble the adhering to documentation:

Proof of ownership and insurance Your license A vehicle inspection A financial institution assertion Proof the auto is compensated off Evidence of long term residency These paperwork give lenders far more self confidence in offering you funds.

You'll require them to determine how considerably you can borrow.

Automobile Title Loans Rely on Fairness Just before lending you money, a dealer will question about equity. You build up fairness by generating lease payments.

If you lately purchased a car with financing, you have quite minor equity in the car. Drivers who owned the auto for a number of many years have far more equity in their rides.

Auto title loans typically occur in little amounts. Many borrowers only acquire a couple of hundred bucks from their mortgage.

Debtors often use automobile title loans for crisis expenses. For how do i get a loan against my car many of them, a few hundred bucks is ample.

Based on your car's fairness, some loan providers will allow you borrow 1000's of dollars.

Reviews